How merchant settlements are processed

Settlement is a process by which a merchant transaction is paid and the platform transfers the funds into the merchant’s account. The settlement can be made into an account inside Pismo (internal transfer) or outside Pismo (external transfer).

Settlement payments are made on the same day as the scheduled payment date; this is to ensure that the settlement amount is aligned with the amount the merchant expects to receive. Although you cannot configure settlement schedules, you can however, configure payment schedules at any time and in any range of days after a sale, see the note in the Settlement scenarios section for details.

Merchant transactions are settled daily according to the settlement schedules; these settlement schedules can only be configured by Pismo and are set to occur at 7 AM GMT everyday. This ensures that settlements occur during early hours of your time zone.

The Merchant transaction settlement event provides information about the settlement timeline and amount a given merchant will receive on a given day. One event is sent for each merchant who has an amount to be settled on that day.

The following scenarios illustrate timeline examples with different settlement stages, starting from regular sales to ones that include cancellation and negative balances. In these illustrations, you learn how different transactions that occur and settle at different points in time affect final settlement outcomes.

Settlement scenarios

Here are the acronyms of the settlement schedules used in the following scenarios:

D0: payment scheduled to be settled on the same day of the sale

D1: payment scheduled to be settled one day after the sale

D2: payment scheduled to be settled two days after the sale

Dn: payment scheduled to be settled n days after the sale

Notes

- Payment schedules can be configured to perform in any range of days after a sale. You can specify the amount of days it takes to settle a payment by sending

first_installment_days_to_paymentandn_installment_days_to_paymentin the Create creditors operation API.- In all of the following scenarios, the scheduled settlement is set to occur at 7 AM GMT every day.

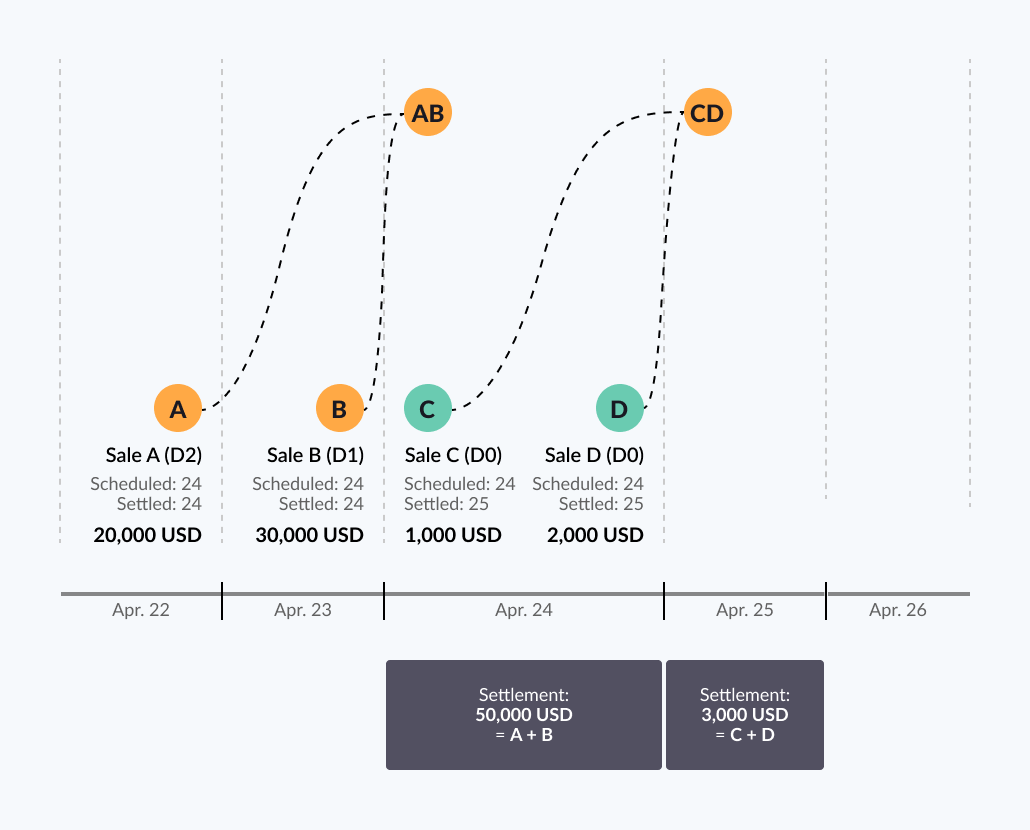

Scheduled settlement

- Sale A (USD 20,000) takes place on April 22nd, and Sale B on the 23rd (USD 30,000), both are scheduled to settle in the morning of April 24th.

- On April 24th, the merchant receives a total settlement amount of USD 50,000.

Scheduled settlements and same-day settlements

In this scenario, the following takes place:

- Sale A (USD 20,000) occurs on April 22nd and the payment is scheduled to settle on the 24th.

- Sale B (USD 30,000) takes place on April 23rd and the payment is scheduled for the 24th.

- Sale C (USD 1,000) occurs on April 24th, and the payment is scheduled for the 25th.

- Sale D (USD 2,000) takes place on the 24th, and the payment is scheduled for the 25th.

- Therefore, on April 24th, the merchant receives the settlement amount of USD 50,000 (Sale A + B), and receives USD 3,000 (Sale C + D) on April 25th.

Note: Sales C and D are both D0 sales; that is, they are supposed to be settled on the same day of the sale. However, since the sales occur after the settlement for the day has already taken place, payments to the merchants can only be made on the next day, which is the 25th.

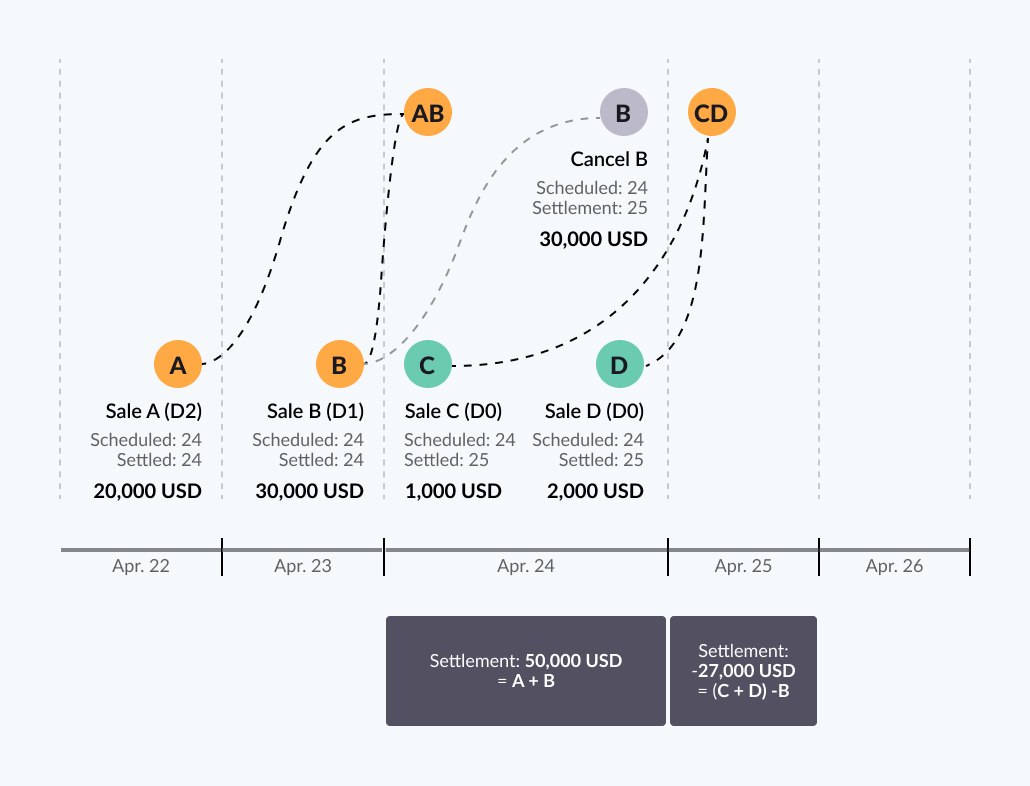

Scheduled and same-day settlements plus cancellation

In this scenario, a cancellation is added to the settlement process:

- Sale A (USD 20,000) occurs on April 22nd and is scheduled to settle on the 24th.

- Sale B (USD 30,000) takes place on the 23rd and is also scheduled to settle on the 24th.

- Sale C (USD 1,000) happens on the 24th and is scheduled to settle on the 25th.

- Sale D (USD 2,000) occurs on the 24th and is scheduled to settle on the 25th.

- Therefore, the total settlement amount for April 24th is USD 50,000 (Sale A + B).

- However, a cancellation of USD 30,000 takes place on the 24th and is scheduled to settle on the 25th; therefore, the final settlement amount on April 25th is USD -27,000 (negative amount).

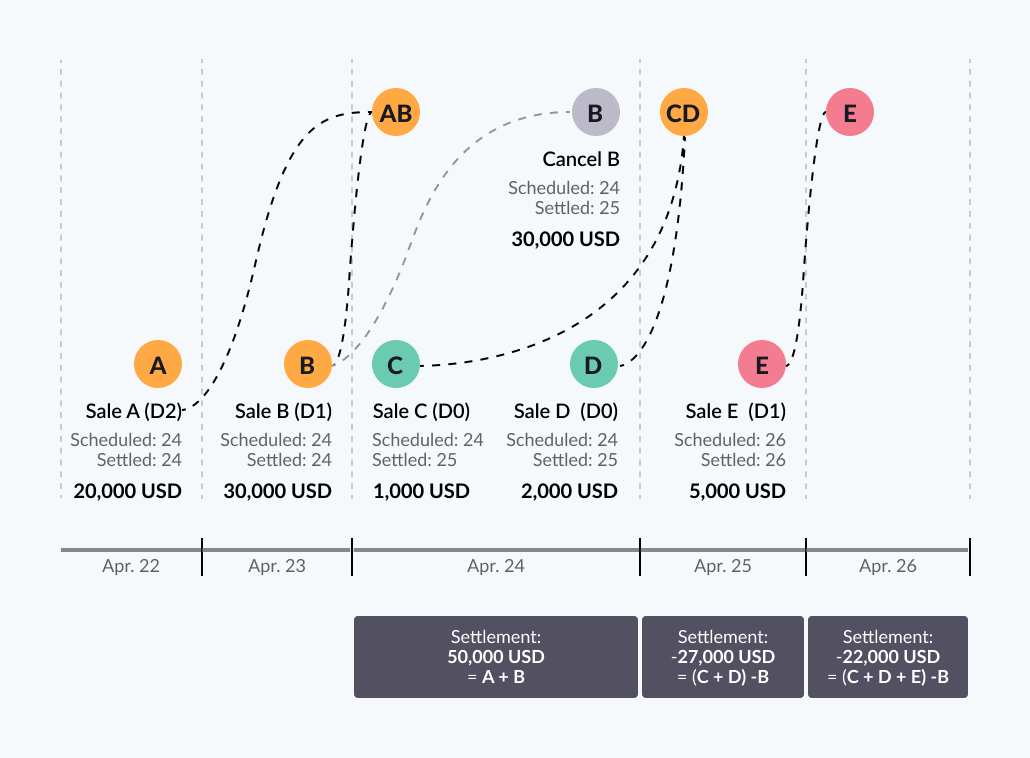

Negative balance

This scenario becomes even more complex when there is a negative balance involved. In this scenario:

- Sale A (USD 20,000) occurs on April 22nd and is scheduled to settle on the 24th.

- Sale B (USD 30,000) takes place on the 23rd and is also scheduled to settle on the 24th.

- Sale C (USD 1,000) happens on the 24th and is scheduled to settle on the 25th.

- Sale D (USD 2,000) occurs on the 24th and is scheduled to settle on the 25th.

- Therefore, on the 24th, the amount that is settled is USD 50,000.

- However, on April 24th, a cancellation of Sale B takes place and is scheduled to settle on the 25th.

- On the 25th, the merchant has a negative settlement amount of USD -27,000 (Sale (C + D) - B).

- On April 25th, Sale E (USD 5,000) occurs and is scheduled to settle on the 26th; as a result, the merchant has a negative balance of USD -22,000 (USD -27,000 + 5,000 = -22,000), and therefore will also not receive the value of the sale, as the balance was negative.

Merchant transaction settlement event

As illustrated in all of the preceding scenarios, one of the complexities is in reconciling settlement values. Therefore, to accurately identify payment dates and the amount that the merchant expects to receive, Pismo provides a Merchant transaction settlement event, which contains the most up-to-date information to help you reconcile and understand how much the merchant can expect to receive on the settlement date. For example, to identify the settlement amount, you use the value in settlement_amount; likewise, to find the settlement date for a transaction, use the settlement_date value.

Updated 16 days ago